CHECK OUT THE SITE: STOCK UP

http://www. nitro-pak. com/

************************************************************************

Scary Parallels of 2008 vs 1929 Stock Market Crash & Depression

************************************************************************

by Harry R Weyandt, Nitro-Pak® President

October 10, 2008 Nitro-Pak Preparedness Center, Inc

I'm not trying to get real technical here, but look closely at the similarities between the U.S. Stock Market Crash of 1929, the crash of the Japanese Stock Market Crash of 1990, and our current U.S.Stock Market Crash

Wow, when I saw the above chart laying out the 3 crashes on top of each other, it took my breath away. Talk about history repeating itself...HOLY COW!!!

Without a doubt, human nature does not change much overtime.Individual and collective greed and fear drives the stock and real estate markets, not only in the US, but the rest of the world Does this ring any bells for you with what's happening right now??

Read on an hold on to your seat for a scary prospect of our future.I have taken the liberty to point out in blue type in the article below the ery similarities of what is happening today compared to the Crash of October 29, 1929 and the beginning of THE GREAT DEPRESSION

Will another Great Depression happen to us? That's the trillion dollar question. Only time will tell. I for one hopes we do not, but feeling either way that it is always a wise and prudent INVESTMENT to prepare for the possible upsides ans well as the downsides... just-in-case

One cannot prepare for every eventuality of life, but you can make a few preparations to lessen their possible impacts on your and your family.What ever you do, don't get overwhelmed and decide its to "hard" and that its "hopeless"

If you can't afford to do all your preparations all at once, don't let that stop you. Make a plan and break it down into small bite sized pieces as your budget will allow.Just systematically put your plan together

In my opinion, the following look at the 1929 Great Depression is a "BLAST-from-the-past" WARNING for us to seriously ponder right now! Do you think for one moment that those folks back in 1929 saw the "Great Depression" coming?

Do you think that some might have been in denial back then? (How about today?). Even after the "crash" of 'Black Monday' October 29, 1929 occurred, did everyone try to sell? No, not even close. The stock market "only" lost 12% on that day.It took 3 more years to drop by 90% of its value

Many prominent "economist" recommended to the public to buy and take advantage of the low price of stocks after the crash.Anyone who did lost it all Now that has a very familiar ring to it today doesn't it!

Could it happen again to us? Are we so much smarter and educated to boast that this could "never-happen-again"? No, not us. I am sure that they said the same thing in 1929.History DOES repeat itself! Will we learn from past history? It looks like we haven't so far

I hope I'm dead wrong, but being the Boy Scout that I am, my motto has always been to "Be Ready and "BE PREPARED". How prepared are you..."just-in-case? CLICK HERE to see my current recommendations to get you started Steps to Consider Taking Right Now

--Harry R Weyandt, President, Nitro-Pak

--------------------------------------------------------------------------------

The Stock Market Crash of 1929

On Tuesday October 29th, 1929, the stock market crash cost the market about 12 percent of its value ( the U.S. Stock Market lost 22%, 2,407 points, of its value (that's more that 10% more than 1929!) in just 8 days from October 1st to October 10th, 2008 which is the largest loss in U.S.history! This is not a good sign

THIS IS A MARKET CRASH of unprecedented scale! It's now been called "BLACK OCTOBER".Hold on, it's very possibly only going to get worst! This could easily become a worldwide chain reaction collapse )

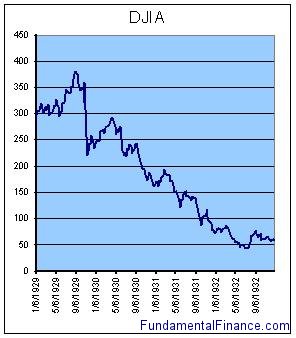

NOTE: Although the loss was staggering at the time, it was only a portion of the loss that was to occur in the following 3 years. In 1932 the DJIA (Dow Jones Industrial Averages) reached a low of just 11% of its high in 1929, or a loss of roughly 89%. The "crash" was NOT a one day event as some would have us believe.It started with a large drop over several weeks beginning in October 1929, but still took years to bottom out

It reached a high of 381.17 in early September of 1929 and a low of 41.22 in July of 1932.Although we can recognize some of the conditions that helped to fuel the stock market crash of 1929, what set it off is harder to determine

COMMENT: The peak of the USA stock market was October 9, 2007 when it hit 14,164.As of October 10, 2008, it stood at 8,451 or a FULL 40% DROP in value over the past 12 months! On October 10, 2008, the stock market opened 128 points down and within minutes went down to over 700 points

Later in the day it was as high as 300 points above the previous market close, a whopping 1,000 point spread in just one day. This was the FIRST this has ever been seen. Confidence in the market has tanked. Faith in the system has vaporized.The President of the United States tried to assure investors and the public help is coming, to which the market only got worst

It has been estimated that over $10 TRILLION DOLLARS have been lost in the stock market alone in the last 12 months.Of that, $2 million has been lost from personally invested retirement accounts)

The 1920's post WWI era was one of tremendous growth, optimism, and prosperity (likewise has our economy been over the past 5 years). Americans had returned victorious and optimistic from the first World War (the 9-11 terrorist attack for us). Industries had been greatly expanded to help support the war (2008: housing boom as people bought more & more on credit and pulled huge piles of money from their home equity to buy bigger homes, second homes, boats, motor homes, vacations, etc.) effort, and these helped establish capital to fuel the growth in the 1920's (for the past 5 years)

Electricity was also becoming mainstream and beginning to make its way into the daily life of regular citizens. Radio became popular and people began to tune into radio programs on a regular basis. Charles Lindbergh made his famous flight over the Atlantic in 1927.Even the first automatic bread slicer was invented in the late 1920's

Economic growth during the 1920's (2003-2008 period for us) was very real--even through 1929.Inflation was low while at the same time real income and production were both rising at over 3% per year (again, very similar to today)

Several companies were increasing their dividend payouts.Leading economists of the day, including John Maynard Keynes, had money invested in the stock market and some even suggested buying after the October 1929 sell-off

During the 1920's (2003-2008 for us) more middle-class and lay citizens began investing in the stock market (it was stocks and prime & sub-prime speculative over inflated real estate for us)

Buying on margin (2008: with little or no credit "stated income loans", little or no money down, and "teaser sub-prime" interest rates this time) became very popular. Margins were generally around 50% at the time--that is, a lay investor could give his broker only 50% of the value of the stocks he wanted to purchase and the broker would put up the rest of the money (2008: margins were only what we put down for our down payment. The leverage was a 95-100% loan.No equity for the lender)

The investor would then pay interest on the loan that the broker gave him--the 50% value of the stocks. If the stocks increased in value then the investor got to keep all of the profit. When he sold he would pay off his debt to the broker (2008: sold or "flipped" the property quickly for a quick buck.Easy money was had everywhere!)

If the value of the stocks were to decrease below 50% (or some set level) of the price that they were bought at, there would be a "broker's call" where the investor would have to give more money to the broker or sell the stock and pay off his debt (2008: you had to make the 'new' higher interest payment as agreed to in your loan docs, or get foreclosed on)

When someone buys on margin, the stock (the home or real estate) itself is acting as collateral.If the value of the stock decreases below the margin, then even after selling the stock the investor would still owe the broker (bank) money

Buying on margin probably helped to fuel some of the stock market prosperity during the 1920's..(just as the sub-prime and prime loan foreclosures have done to the banks over the past 2 years)

At the time buying on margin (sub-prime or "stated income" loans) wasn't regulated so the brokers could choose the margins they were willing to give

In fact, by the end of October 1929, the average margin had decreased by about 25%--worsening the situation (get into homes with "no-money-down")

Buying on margin (little or no-money-down, sub-prime rates as low as 1% "teaser", negative amortization loans, etc.) allows investors to buy more (house) than they otherwise could have

For example, if Henry thought that stock ABC (that big home that was way bigger than he could really afford) was a good buy and he had $1000 to spend (almost no money needed), if he bought on a 50% margin(0-3% down payment) then he could buy $2000 (a much bigger house) worth of ABC stock instead of just $1000 (the home he really should have purchased under traditional lending standards)

This has a tendency to push the market up

Imagine one million (or 10 million) "Henry's" being able to double (or multiply your "profit" many times over what you put down out of your pocket) the amount of money they were willing to invest in the stock (real estate) market

There is not a lot of evidence that most stocks (homes) were "overpriced", the average Price Earnings (P/E) ratios of stocks was only around 15 by 1929.Today the S&P 500 is has an average P/E ratio around 21

However, there is some evidence than public utility stocks were overpriced.Public utilities are regulated--that is, the government sets a limit on how much they are allowed to earn

The prices of public utility stocks were high given their government-set return limits. Public utilities can earn excess returns because of weather or regulation lag, but nothing extraordinary.Public utility stock prices seemed to indicate otherwise

The media seems to have been part of the cause of the October sell-off (sound similar to today).In the weeks preceding Black Thursday (October 24, 1929) many articles surfaced asserting that there was too much speculation in the American stock market (real estate market) and that stocks (real estate properties) were overpriced

In October front page headlines discussed recent market losses and questioned whether share-holders were beginning to pull out (2008: The media has been doing the same since last year as "teaser" sub=prime loans started re-pricing higher [4-6%] and foreclosures climbed)

Evidently this feeling trickled down to make investors nervous.The market lost about 6% from the beginning of September to October 27 (the Sunday before Black Tuesday) (2008: Stock Market lost over 12% in just 2 weeks in late September and the first 7 days of October)

On Thursday, October 24, 1929, the largest volume ever traded on the New York Stock Exchange was recorded--12,894,650 shares--crushing the previous record of 8,246,742 shares set in March

The volume was so high that the market tickers got over an hour behind (not a problem for today's high-speed computers).The market lost value early in the day but then regained it later on (on October 6, 2008 the market lost up to 800 points, about 8% [then settled at only a 368 point 'loss'])

New York bankers were given credit for stopping the crash as they put about $1 billion into the market (FED bailed out AGI, Freddie Mac, etc. That didn't work so Wall Street looked to Congress & the American Tax payer. On October 3, 2008, the "Bail-Out Bill" for $700 Billion + $150 Billion dollars in "sweetner's" passed.Monday, October 6th saw a stocks drop around 250 points and another 508 points on Tuesday, October 7th)

Over the weekend the New York Times reported that Massachusetts regulators weren't going to be as friendly towards public utilities. On Monday 9,212,800 shares were traded. Finally on Tuesday, October 29, 1929, 16,410,030 shares were traded and the market suffered a staggering crash of about 13%.During the week the market would lose 30% of its value

The nervousness that existed among investors caused many people to sell once they saw the high volume and the ticker-lag (2008: As many have done since seeing their life's savings evaporate)

It's as if you were in a movie theater and someone screams "Bomb!" Buying on margin also helped to push the market down once the crash began.When stock prices fell, investors were forced to sell their shares so that they could pay back their brokers (or they could try to cash out to not lose their homes to foreclosure)

This forced prices further down and the cycle continued (about what we lost in 2 weeks the at he end of September thru October 7th, 2008)

When investors couldn't pay back banks the money they had borrowed, banks began to fail (2008: after having so many foreclosure properties taken back and no longer getting any monthly payments to cover anything)

Banks had also invested money in the stock market (real estate loans), but even a well diversified portfolio couldn't protect anyone from the crash that occurred (real estate investments banks, regional banks, overseas banks, etc.REAL ESTATE IS NOT A LIQUID INVESTMENT!!)

For a while banks borrowed money from the Federal Reserve System (just like they have been do so for most of 2008 by the BILLIONS), but eventually no more funds were available and banks began to break by the hundreds (We're not here yet."Only" dozens so far)

If people thought that their bank was going to fail they would run to withdraw their money (a "run-on-the-bank"), making matters even worse (that is exactly the reason that the "FDIC's 200 failing bank list" NEVER is seen by the public before it goes in after hours and closes a bank.The next day, it is "usually" taken over by some other bank the FED has made a deal with)

Eventually, in 1932 the market bottomed out.By this time the Great Depression was very real and it would take another 23 years before the market would ever fully recovered from stock market crash of 1929

CLOSING COMMENT: Are you still breathing? Do you "see" things a bit different now? What will it take for the majority on the sidelines to hit the panic button and sell out? How far does the stock market have to drop before it free-falls. No one knows that answer.Everyone is spooked and on the edge

So what should you do? I have made a quick list of important things to consider doing right now to start getting better prepared to protecting you and your family form the disaster that may be directly ahead Steps to Take Now

*************************************************************

How Do I Prepare for a Severe Recession/Depression?

*************************************************************

by Harry R Weyandt, Nitro-Pak® President

October 10, 2008 Nitro-Pak Preparedness Center, Inc

There is NO DOUBT that today we are in a severe, prolonged economic RECESSION and possibly headed for a DEPRESSION. In fact, a poll this week shows that 60% of Americans think we are headed for a Depression.Many clients are worried, as I am too for my family, children and grandchildren

Many of these clients have asked what I am recommending to my friends to help get them better prepared right now to weather-the-storm ahead

First, I'd ask you what your gut tells you.If you're not convinced we are in serious trouble, I would tell you to sit down and read this: Scary Parallels of 2008 vs 1929 Stock Market Crash & Depression

Overall, I'm an optimist, but I'm a realist also and I don't like what I see on the horizon. The Boy Scout's taught me a thing or two about "Being Prepared".Preparing is just that, thinking ahead for possible good and not so good outcomes

The Scout motto to "Be Prepared" should be the watch word of the day.It can calm nerves and bring greater-peace-of-mind and security to you and your loved ones

Since the middle of September, the demand for our long storing foods and supplies has been very high.We are shipping orders as fast as possible but supplies are disappearing quickly

Being prepared means getting ready before you need it, not afterwards when the panicking crowds will find out that they are too late. The supplies will all be gone. I have seen it many times in my over my 24 years in this business. It could happen again at any moment.Am I suggesting to you to sell all your stocks, bailout of your 401k's and IRA's? NO! I'm simply saying, whether it is an economic crisis, earthquake, etc, be prepared with an emergency backup plan with a portion of your assets as your own personal safety-net

Disasters, job losses, economic strife, etc. do happen to good people in both good times and bad.It is simply prudent to be prepared as best as you can for life's curve balls

If we could sit and chat in my office for just a few minutes (my wife would tell you that you'd be here much longer than that) we'd talk about what I'm currently recommending to my friends and clients

So below are my 4 "quick list" recommendations for you to do now if your haven't done so already

So what am I recommending to my clients right now?

1) STORE FOOD. It's the only INVESTMENT you can eat. If you have not done so yet, get a 6 month to 1 year supply food emergency food for each family where possible.Whether it is a Stock Market crash, job loss, or natural disaster, an emergency backup plan is always a wise INVESTMENT

Even a few month food reserve is better than nothing.This could be a be with a combination store bought non-perishable foods and long term freeze-dried or dehydrated foods

Mountain House's 25 year shelf-life freeze-dried foods are my #1 Recommendation.Not only do they store longer than any other food product, they are excellent tasting and super easy to store Emergency Food Reserves

By far, this is my top PREPAREDNESS RECOMMENDATION If you have not already put together or purchased an emergency food reserve, do it right now while supplies are still available and before prices go up!

Food supplies are always made to meet current demand with little back-stock. When the panic sets in and you see the story on the 6 o'clock news, it will be too late.It will be like trying to buy insurance when the house is on fire It will be too late! Please, do not delay this VITALLY IMPORTANT STEP! Your family is depending on YOU!

2) STORE EXTRA LIFE NECESSITY 'BARTER' GOODS: You know, things like toilet tissue (ESSENTIAL! Just think how life would be without it), hand soap, deodorant, shampoo, shaving razors, tooth paste, feminine hygiene items, child diapers, etc

These items can be purchased in bulk and rotated and replaced throughout the year.Great inflation hedge

3) HAVE CASH $ ON HAND. GET LIQUID. What if there is a 'bank holiday' where the FED temporarily closes all nations banks due to a "run" on the banks (like what we saw happen to the INDY bank in California).It could happen again

Now don't get me wrong.I'm not suggesting cashing out of everything, just get more liquid

I highly recommend a "cash" reserve of 1 to 3 months living expenses stored AWAY from your bank. Keep this low key for safety and do not tell anyone about it. I suggest going to another bank branch where no one may know you personally (tellers some times talk to others).It is your emergency backup fund

Get only $1, $5, $10's & $20's for this reserve. No $50's or $100's. You may not be able to get change easily. If you want to take out more, assuming you have more, see recommendation #4 below).Only takeout less than $10,000 at a time to avoid bank reporting rules

4) GOLD & SILVER RESERVE. Not for the faint of heart (neither is stock for that mater). Gold is not so much an investment, but a holder of value over time. It is a hedge against a banking collapse and future inflation.In tough times, it always goes up

Back in the 1920's, a $20 one ounce gold coin would purchase a fine men's dress suit.Today, that same $20 one ounce gold piece could still buy a very fine men's suit (or more)

HERE'S MY GOLD & SILVER RECOMMENDATIONS: Buy silver 90% Junk Silver first. These are U.S. 10, 25 & 50 cent coins minted in 1964 or before.They are available at most coin stores and many pawn shops and are sold by the single coin or bag (bags can be anywhere from $100 face value to $1,000)

Check the internet for their current pricing. Call around and get price quotes. At this writing, they are selling for around 9x face value ($1 face = $9 cost).Costs will fluctuate daily

Another great way to store silver is with privately minted 1 ounce silver round coins (A-Mark, Englehart, etc.). Silver rounds typically sell for about .40 to $1 over the 'spot' silver price. The U.S.Silver Eagles are way over priced at $2 to $3 over spot

Both the 90% junk silver coins and 1 ounce silver rounds are easily sold and traded anytime

As for gold, ONE OUNCE American Double Eagles or Canadian Maple Leaf's are my favorites.You will pay a few dollars more for the Eagles, but you will also realized a slightly higher resale value when you sell them too

You will usually pay somewhere around $40 - $60 over spot depending on market demand and dealer premium. I do not recommend bars of gold or silver. Also forget about rare coins.Not nearly as liquid to sell

You can usually get these coins in small qualities from local coin stores and some pawn shops, or for larger purchases, from companies like MONEX Precious Metals at 1.800.9494653 x2546 (Bryce), or www. goldsilverbullion. com (Dave).Both companies will treat you good (I get no commissions or kickbacks from either company)

Well, these are my top recommendations to meet the possibility of tough times ahead.They are not all inclusive, but a great start

Just remember the four "G's": Gold, Guns, Groceries and God, not necessarily in that order

Will Rodgers once said, "Invest in inflation.It's the only thing going up" Pretty good advice, especially today!

Be Ready...Be Prepared!

--Harry R Weyandt

© 2025 Created by James and Terry Hamilton.

Powered by

![]()