August 27, 2008 - ALL FDIC IS GOOD FOR IS BEGGING THE FEDS AND TREASURY TO PRINT MORE GODDAMN MONEY AT TAXPAYERS EXPENSE - YEAH TRUST THEM UNTIL THEY LOAN YOUR CHILDREN TO INTERNATIONAL CREDITORS (AND THAT AINT A JOKE ACCORDING TO US BIRTH CERTIFICATE)

**********************************************************************

FDIC Running out of Cash: No Bank is Safe in this Alarming Atmosphere

**********************************************************************

The Age Australia

September 18, 2008

Be very, very careful. There are reports the US Federal Deposits Insurance Commission is running out of money. Chairman Sheila Blair has been forced to issue a statement."US banks are overwhelmingly safe and sound and the Government fund used to cover insured deposits will be adequate to absorb any losses, even high losses," she says

But Brian Bethune, US economist at consulting company Global Insight, said: "Additional failures of large banks or savings and loans companies seem likely, and that could overwhelm the FDIC's insurance fund"

Christopher Whalen, senior vice-president and managing director of Institutional Risk Analytics, said: "We've got a … retail bank run forming in this country"

On Monday, US Treasury Secretary Henry Paulson said the nation's commercial banking system "is safe and sound", and that "the American people can be very, very confident about their accounts in our banking system"

FDIC officials say 98% of US banks still meet regulators' standards for adequate capital

Associated Press reported that the FDIC was down to $US45.2 billion ($A57 billion) - the lowest level since 2003

Whalen then wrote that reports the FDIC was running out of cash had no basis

His statement said: "It is essential that people realise the US Treasury will advance whatever cash is needed by FDIC to address bank failures and make good the deposit insurance guarantee. There is no issue regarding the bank insurance fund, but unfortunately most of the public do not understand this.The FDIC needs to make this clear in all of its public statements"

IRA has been constantly in contact with the FDIC and other regulators and knows more about this situation, I would suggest, than the US Government

The situation may not have been helped by a report from American Banker concerning the deal by Bank of America, the FDIC's biggest customer, with 10% of the nation's deposits, to take over Merrill Lynch saying "it is unclear how much that acquisition would increase B of A's risk profile"

It is an intricate game, with the stability of the nation's finances on the line.American Banker says regulators will meet the Senate Banking Committee, which is "increasingly worried about the FDIC's ability to pay for the growing number of bank failures, and relaxing the barriers between banks and the riskier affiliates is likely to raise some concerns"

Read The Rest HERE

Treasury Secretary Henry Paulson speaks at a press conference on Comprehensive Approach to Market Developments at the Treasury Department in Washington, September 19, 2008

*******************************************************

Paulson: Foreign banks can use U.S rescue plan (dumping foreign debts on YOU)

*******************************************************

Reuters

By Mark Felsenthal

Sun Sep 21

http://news. yahoo. com/s/nm/20080921/bs_nm/financial_bailout_pauls...

WASHINGTON (Reuters) - Treasury Secretary Henry Paulson said Sunday that foreign banks will be able to unload bad financial assets under a $700 billion U.S.proposal aimed at restoring order during a devastating financial crisis

Yes, and they should. Because ... if a financial institution has business operations in the United States, hires people in the United States, if they are clogged with illiquid assets, they have the same impact on the American people as any other institution," Paulson said on ABC television's "This Week with George Stephanopolous"

Paulson was appearing on the Sunday television talk show circuit to provide details about the U.S.government plan for a sweeping bailout to mop up hundreds of billions of dollars in toxic mortgage debt

The moves capped a week in which financial markets faced their most serious confluence of crises since the Great Depression in the 1930s and threatened national economies and the worldwide banking system

Paulson defended the rescue package as painful and costly, but necessary to stabilize a financial system that has all but ground to a halt

"The situation we had, where the markets are frozen and lending may not be available, is one that won't be good for the American people," he said

"The fact that the taxpayer is in this position is painful to me"

Paulson acknowledged that an emergency rescue plan aimed at stabilizing a financial system in freefall will cost taxpayers money, but argued that costs will not be as high the $700 billion limit of the package

"The taxpayer is at risk," he said on "Fox News Sunday" television program, but added, "It would be extraordinary circumstances, highly unlikely, that the cost will be anything like the amount you spend for the assets"

Paulson said the U.S.government is pressuring financial authorities in other countries to adopt similar financial stabilization plans

"We have a global financial system and we are talking very aggressively with other countries around the world, and encouraging them to do similar things, and I believe a number of them will," he said

Paulson said the sudden crisis was stunning but he expressed hope in U.S.economic resilience

"I wouldn't bet against the long-term fundamentals of this country," he said on NBC's "Meet the Press." "But this is a humbling experience to see so much fragility in our capital markets, and ask how did we ever get here"

"I'm confident Congress will move and move quickly," Paulson he added

********************************

Bernanke: 'We have lost control'

Economist recounts talk with Fed chairman

********************************

By Joshua Boak | Chicago Tribune reporter

September 17, 2008

NAPLES, Fla.— Several months ago, economist David Hale had a private meeting with Federal Reserve Chairman Ben Bernanke, who was trying to ward off a recession by lowering interest rates and increasing the money supply in the economy

The problem with that approach is that the value of the dollar plunged against foreign currencies, causing crude oil prices to skyrocket because oil is pegged to the dollar.It affected food prices, gasoline and family budgets

"Ben, you are playing a very unique role in world economic history," Hale recalled telling Bernanke, an expert in the Great Depression."You are the first central bank governor of the United States to preside over a recession with no decline in commodity prices"

Bernanke could hypothetically limit inflation in commodities by raising interest rates, a policy that would restrict the flow of money but potentially lead to an avalanche of bank failures.At a financial conference in Florida on Tuesday, Hale, a Chicago-based economist for investment managers, hedge funds and multinational companies, paraphrased the Fed chairman's response

"We have lost control," said Hale, quoting Bernanke. "We cannot stabilize the dollar.We cannot control commodity prices"

Read The Rest HERE

*****************************************

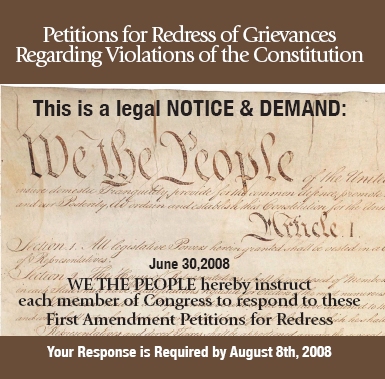

WTP Brings Federal Lawsuit to Stop AIG Bailout

*****************************************

September 18, 2008

U.S Lacks Constitutional Authority for Loan

http://www. wethepeoplefoundation. org/Update/Update2008-09-18. htm

On the day following the 221st anniversary of the signing of the U.S. Constitution, WTP Chairman and constitutional activist Robert Schulz today filed a federal lawsuit in United States District Court in Albany seeking to halt the execution of the emergency bailout of American International Group, Inc.(AIG) by the United States Government and the Federal Reserve

The lawsuit asserts that the commitment of public funds and credit for the direct benefit of privately owned AIG is an ultra vires action by the United States Government and Federal Reserve, i.e., beyond the limited legal authority granted by the Constitution.The lawsuit asks for a "show cause" hearing demanding that the Government produce evidence of its legal authority to commit public funds for such a purpose, as well as emergency and permanent injunctions halting the bailout transaction

Beyond the Constitutional deficiencies, the bailout establishes a dangerous precedent enabling the Fed and/or Government to nationalize virtually any business or property within the United States without legal authority or congressional approval

The defendants include the Federal Reserve System, Fed Chairman Ben Bernanki, the U.S. Treasury, Treasury Secretary Hank Paulson Jr.and the United States Government

The WTP Foundation today issued a press release citing Schulz:

"Beyond the moral hazard and dangerous precedent established by this action, it is of vital importance that the American people recognize that the present financial crisis is a direct and predictable result of decades of constitutional violations by the Federal Government.Through a long-standing policy of disinformation and collusion with the Federal Reserve and Wall Street financial elite, the United States Federal Government has denied public access to information about the secretive operations of the privately owned and operated Federal Reserve and its monopoly control of America’s money system

"This monopoly control of our currency by a private banking cartel has resulted in increasing distortion, volatility and cyclical (boom and bust) economic conditions in the U.S. and abroad. America’s fiat currency (produced from thin air) is manipulated by the Federal Reserve for the benefit of its owners, major Wall Street financial institutions and the Federal Government and is not unaccountable to the taxpayers. These abuses of the Constitution have taken our financial system to edge of the abyss.The chickens have come home to roost"

Click here to read the Complaint, the Memorandum of Law supporting the TRO, and Schulz's Declaration which includes several recent articles from the New York Times

Sign the petition here to stop the Feds insane bailout of criminal bankers

http://www. givemeliberty. org/revolution/#revSignPet

© 2025 Created by James and Terry Hamilton.

Powered by

![]()